If an appraiser is certified or licensed in their state they are required to perform appraisals according to the most current Uniform Standards of Professional Appraisal Practice (USPAP). These standards are the definitive standards of the appraisal profession, developed for appraisers and the users of appraisal services by the Appraisal Standards Board (ASB) of The Appraisal Foundation. In 2010 the Appraisal Practices Board (APB) was developed by the Appraisal Foundation. The APB now has the task of identifying and issuing opinions on Recognized Valuation Methods and Techniques, which may apply to all disciplines within the appraisal profession. The APB will offer voluntary guidance in topic areas which appraisers and users of appraisal services feel are the most pressing.

The Dictionary of Real Estate Appraisal, Fourth Edition, defines an appraisal as “The act or process of developing an opinion of value; an opinion of value. Of or pertaining to appraising and related functions such as appraisal practice or appraisal services.” (p. 15) An appraisal is defined as “The written or oral communication of an appraisal; the document transmitted to the client upon completion of an appraisal assignment. Reporting requirements are set forth in the Standards Rules in Standard 2 of the Uniform Standards of Professional Appraisal Practice.” (p. 16)

We provide appraisal services for the following types of properties:

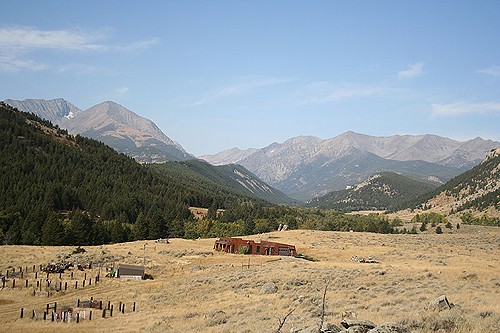

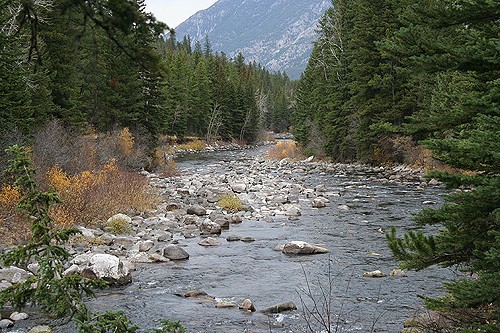

- Ranch (full-time operations and part-time)

- Recreational ranches

- Recreational tracts

- Farms (Irrigated and dryland)

- Dairies

- Rangeland tracts

- Horse facilities

- High Mountain Tracts

- Mining Claims

- Larger tract rural residential

- Rural acreage tracts

- USFS, BLM, and State Inholdings

Terra Western Associates provides the following types of appraisals:

Estate Planning and Settlement Appraisals

Estate planning can be one of the most exciting yet difficult tasks in life. Passing on a farm, ranch, or any other type of property to our loved ones over time can facilitate a smooth transition from one generation to another. Appraisals are an essential part of this transition as portions or shares of the property are gifted or purchased by a related party. The IRS considers gifting ownership in property as a reportable event. A high quality appraisal validating the value of the gifts can aide in the reporting of these events.

Additionally, when we lose a loved one an estate settlement process is initiated. If the estate is large enough to be taxable an appraisal is required to validate the property value and the appraisal is often submitted with the estate tax return. Estates with rural properties as a large portion of the asset base are often audited by the IRS, and a properly supported and well documented appraisal can facilitate a smoother audit process or possibly avoid one altogether.

Appraisals for Financing

The lending industry has strict regulations regarding valuation procedures prior to executing loans where real estate is the primary collateral. An appraisal is necessary to calculate the loan to collateral percentage and to assist in qualifying the customer for a loan. Appraisals also inform bankers about the market in which they are lending so that they can determine if the loan is a good risk or not. An appraisal for financing must meet USPAP requirements, FIRREA regulations including the 1989 regulations and the 1994 update, Interagency Appraisal and Evaluation Guidelines (October 7, 1994) and often must comply with institution specific supplemental guidelines. The main purpose of these guidelines is to assure the safety and soundness of the loans being made by any institution. Quality appraisals in this area are a must in order to assure proper asset management.

Appraisal Review

Appraisal review services include reviewing the work of another appraiser for purposes of determining whether or not the assignment was completed competently and in compliance with the regulations under which the appraisal was performed. A review can be a desk review or technical review or it can be a field review where the appraiser visits the property and sales and reviews the work in more detail. Each review assignment is specific and the type of review requested must be communicated clearly at the beginning of the process.

Conservation Easement Appraisals

Conservation easement appraisals are specifically for the donation or purchase of a conservation easement. If a donation to a non-profit land trust is part of the equation and the landowner wishes to take a charitable donation tax deduction the appraisal must be an IRS Qualified Appraisal performed by an IRS Qualified Appraiser. IRS Code Section 170 explains in detail the details of a charitable contribution consisting of a conservation easement.

The Internal Revenue Code and Treasury Regulations provide specific requirements for a “qualified appraisal” and a “qualified appraiser”. The donor of a conservation easement should be aware of the detailed requirements related to a qualified appraisal and qualified appraiser as set forth in Section 170(f)(11) of the Internal Revenue Code and Section 1.170A-13(c)(3) & (5) of the Treasury Regulations.

A qualified appraisal must comply with all the requirements of Treasury Regulation Section 1.170A-13(c)(3) and must be conducted by a qualified appraiser in accordance with generally accepted appraisal standards. It will be treated as meeting generally accepted appraisal standards if, for example, it is consistent with the substance and principles of the Uniform Standards of Professional Appraisal Practice. A qualified appraisal must be made no earlier than 60 days prior to the date of contribution of the appraised property and received by the donor before the due date (including extensions) of the return on which a deduction is first claimed.

Under Internal Revenue Code Section 170(f)(11)(E)(ii), a qualified appraiser is an individual who regularly performs appraisals for compensation and who has earned an appraisal designation from a professional appraiser organization or has met minimum education and experience requirements as set forth in regulations. Notice 2006-96 provides that, until regulations are promulgated, an individual will be treated as meeting the appraisal designation requirement if the individual’s appraisal designation is awarded on the basis of demonstrated competency in valuing the type of property for which the appraisal is performed. For an appraisal of real property, the appraiser will be treated as having met minimum education and experience requirements if the appraiser is licensed or certified for the type of property being appraised in the state in which the appraised property is located.

Under Internal Revenue Code Section 170(f)(11)(iii), for each specific appraisal, an individual will not be treated as a qualified appraiser unless the individual demonstrates verifiable education and experience in valuing the type of property subject to the appraisal and has not been prohibited from practicing before the IRS at any time during the 3-year period ending on the date of the appraisal. Notice 2006-96 provides that an individual will be treated as meeting the verifiable education and experience requirement if the appraiser makes a declaration in the appraisal that because of the appraiser’s background, experience, education and membership in professional associations, the appraiser is qualified to appraise the type of property being appraised.

Conservation easement appraisals are complicated in that they are two appraisals in one. Conservation easements appraisals are typically performed in the “before” and “after” method whereby the property is appraised unencumbered by the easement and then appraised again in its encumbered state. The difference in the two appraisals is the amount of the decrease in value due to the effects of the conservation easement and this number is often referred to as the charitable donation in a straight donation situation. However, in a purchased easement scenario the difference could include a portion of the property rights that will be purchased plus a bargain sale component. The bargain sale component becomes the charitable donation to the land trust or government entity. Proper documentation of the loss in value is key. Terra Western Associates maintains a database of sales of properties which have sold after they have been encumbered by a conservation easement. Having the proper sales data and the skills to implement their use is critical in the conservation easement process.

Government Trade or Acquisition

These appraisals are typically Yellow Book (USFLA) appraisals. However, when they are with the state they can be USPAP appraisals. These types of appraisals are necessary in several circumstances. Occasionally, the government will approach a landowner about acquiring their land to block up government lands for ease of management. At other times the government will offer the landowner a trade in like-value, like-kind lands in order to block up both the landowners ranch and the government lands. Additionally, landowners might approach the government to purchase their lands in order to block up land in order to provide the public with substantial public use areas. The Federal Government is required to pay a landowner market value as established by a qualified appraisal. Therefore, quality appraisal products that serve the process are very important. State acquisition and trade laws vary between states regarding appraisal procedures. It is best to consult with the appropriate agency as to their requirements.

Litigation

Most of the litigation work we do at Terra Western Associates concerns family law and includes family settlements in the splitting of entities and divorces. Most of these cases require a USPAP compliant appraisal in order to establish asset value for the determination of the division of property.

Real Estate Consulting

Often a buyer, seller, or other real estate professional will require our expertise in the area of real estate consulting and feasibility analysis for the sale or purchase of a property. We are happy to provide this service which centers more around the selling aspects of real estate and due diligence matters.